Digital connectivity and globalization are accelerating international expansion and collaboration like never before. However, while physical borders are no longer barriers, language barriers are still persistent.

With effective multilingual communications and high-quality financial translation, you can streamline your company’s market entry and confidently connect with potential customers and partners.

But here’s the catch: To say that financial translation is challenging is an understatement.

Since financial translation plays a significant role in your decision-making and strategic planning, mistakes are intolerable. They can lead to costly errors, regulatory violations, and even reputational damage.

So why is it so challenging? Keep reading for a breakdown of the challenges of this specialized type of translation.

What Is Financial Translation?

Financial translation is a crucial part of the financial industry as a whole. It refers to the specialized process of translating financial content into one or more languages while maintaining complete precision and clarity.

But what type of financial documents would need translation services?

During this linguistic conversion, and more than any other type of translation, nothing should get lost in financial translation. The ultimate purpose is to make the content accurate and comprehensible in different languages as well as preserve the integrity of the source material.

You see, the integrity of numbers and words is the foundation of trustworthy financial transactions and informed strategic decisions.

And due to the sensitive nature of financial content, a single mistranslation, a misplaced comma, or an extra zero might seem trivial at first glance, but they can lead to significant financial and legal consequences.

That’s why, in several cases, a certified translation is required from financial translation agencies, because it’s a quality guarantee.

However, financial translation extends to include the adaptation of financial concepts and terminology, cultural nuances, as well as regulatory contexts to ensure the translated content resonates in the target regions.

It’s not as simple as replacing words in a new language; it’s a complex process of accurately translating financial data, complying with industry standards, and maintaining the transparency of financial documents.

Who Needs Financial Translation?

Finances are an integral part of almost every institution, from non-profit organizations and academic institutions to banks and the stock market. And to a certain extent, they need financial translation, whether to pursue global investment opportunities, partnerships, or business expansion in new markets.

So, who are these?

1. Corporations

Companies engaged in international trade and cross-border transactions rely on financial translation since their financial exchanges happen between people who speak different languages. This includes translating financial reports, contracts, and market analyses to effectively communicate with stakeholders across different linguistic backgrounds.

2. Financial Institutions

Global and regional financial institutions, such as banks and investment firms, deal with clients and partners from around the world. Accordingly, they may need to translate their financial documentation and information including loan agreements, investment portfolios, and regulatory documents.

3. Stock Traders

Stock traders in the stock markets often need financial translation due to several factors, including regulatory compliance. For instance, companies listed on international exchanges often need to provide financial documents in multiple languages.

Why?

Although it’s not exactly mandatory, it falls under the stock market’s rule of “transparency”. You can’t provide a stock exchange with integrity and transparency if other traders don’t really understand your language.

4. Legal Firms

Finance lawyers in mega legal firms work with international financial cases, mergers and acquisitions, and contract negotiations. They often need to translate financial documents such as contracts, agreements, and legal disclosures to represent their clients’ interests in their native language.

5. Multinational Organizations

Multinational corporations that operate in various countries around the globe need financial translation to ensure consistent, accurate, and transparent financial communication across their global network.

6. Small and Medium Enterprises (SMEs)

Small and Medium Enterprises (SMEs) tend to prioritize emerging markets for their expansion plans.

Why? Simply because it’s a low-risk environment, and there they can test the water. For instance, UK businesses usually begin global expansion by exporting to Singapore or Hong Kong before moving into the rest of Asia because these countries constitute a “low-barrier” market that minimizes risks.

For this, they often need financial translation to facilitate business exchanges and negotiate contracts.

3 Key Challenges of Financial Translation that May Hinder Your Global Aspirations

For businesses and investors seeking to navigate international markets, financial translation becomes a crucial tool for market penetration and growth.

On one hand, it empowers them to assess opportunities, inform their decision-making, and streamline cross-border investments. On the other hand, it helps them confidently navigate the complex legal and regulatory framework that governs finances across different regions and different jurisdictions.

But if financial translation is that powerful, how come businesses still seem wary of integrating it into their expansion strategies?

From a business standpoint, the challenges associated with financial translation introduce a level of risk, potentially causing businesses to pause before taking the step into financial translation.

1. Financial Terminology

As is the case for many technical fields, the field of finance has very specialized jargon. Much of its terminology is context-specific and may have different meanings in other contexts.

The nuances of financial terms, jargon, and concepts can be difficult to accurately translate, particularly when there is no direct equivalent in the target language. The risk lies in misinterpretation or the loss of key details during translation, potentially leading to incorrect decisions, miscommunication, and regulatory non-compliance.

Let’s take the word “Coupon” as an example.

Another example is the term “common stock,” as used in the U.S. but referred to as “called-up share capital” in the U.K.

In finances, you’re looking for utmost accuracy and professionalism. You can’t afford to have a document that sounds gibberish and unspecialized.

And since the meaning of words can remarkably vary depending on the discipline, providing an accurate translation can be challenging.

To ensure specialized financial translation, you need native fluency and subject-matter expertise. Only a native with a financial background would know the common jargon of the field. In addition, you need to make sure your language service provider employs a rigorous quality assurance process to ensure there are no mistakes.

Otherwise, you might end up with an erroneous document that would have many repercussions.

2. Numbers

Finances are all about numbers. Sounds easy? Well, people never consider numbers to be a hustle when it comes to financial translation, but localizing numbers is actually a big deal!

Let’s look at some considerations for numbers in financial translation.

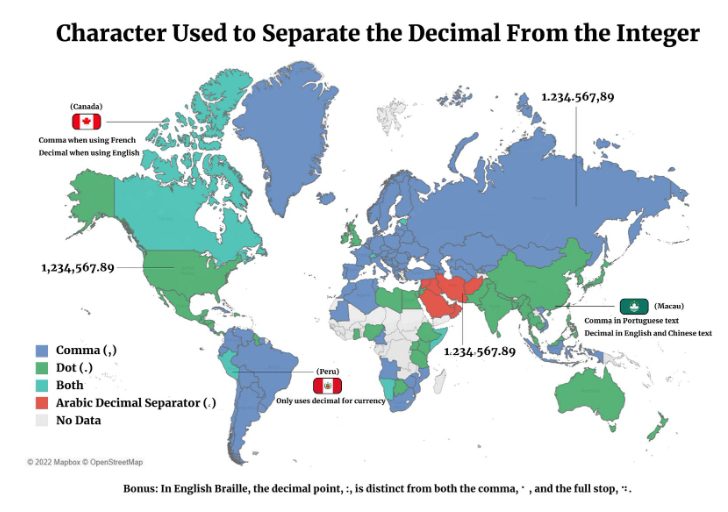

➥ Numerical Formats

Different countries use different numerical formats. For instance, while some countries, such as France, use a comma as a decimal separator and a period as a thousand separator (1,000.00), others, such as England, do the opposite (1.000,00).

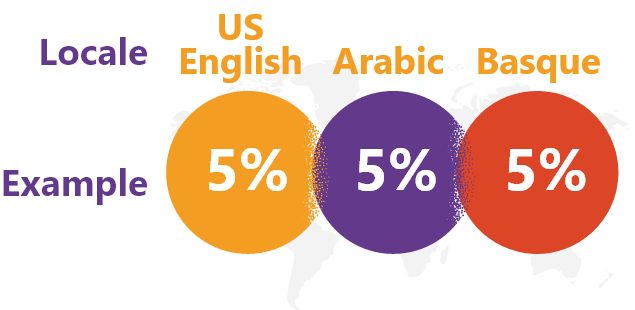

➥ Percentage Formats

Percentage formats can differ from one country to another as well.

In English-speaking countries such as the United States and Canada, the percentage symbol is usually placed after the number without any space (e.g., 25%), but the percentage symbol is often placed after the number with a space (e.g., 25 %) in some European countries where a comma is used as the decimal separator (e.g., 1,000.50).

On the other hand, in Arabic, the percentage symbol is often placed before the number with a space (e.g., %١٥).

➥ Rounding

Different languages and cultures have varying conventions for rounding numbers.

Although most European countries follow the “round half up” rule, in the Netherlands, a variation of the “round half to even” rule is used. Known as “rounding half to the nearest even digit”, this means that 2.5 rounds to 2, while 3.5 rounds to 4.

3. Confidentiality

Financial documents and reports necessitate a high degree of confidentiality due to the sensitive information they encompass.

Confidentiality breaches aren’t an easy matter. Many institutions, such as banks and corporations, have faced huge penalties and, in severe cases, bankruptcy due to data leaks.

That’s why many hesitate to go for financial translation.

To safeguard your confidential financial documents, you must ensure that translators working on your project are required to sign non-disclosure agreements (NDAs). In addition, you must mandate the financial translation agency to sign your personal NDA.

Moreover, it’s critical to ensure that the agency doesn’t rely on machine translations since most of those are open-source and may leak sensitive data.

Lastly, you must ensure that proper data security is taken into account. Your financial information cannot be disclosed through email or on chat apps that aren’t encrypted.

Financial Translation Frequently Asked Questions (FAQs)

- Does financial translation include currency conversion?

You may not always need to convert your currency for financial documents; it depends on the context and target audience. Your financial translator may assist, but ultimately it is your call.

- Is financial translation subject to regulations and standards?

Yes, financial translation often needs to adhere to regulatory guidelines, industry standards, and reporting requirements specific to each country’s financial markets and regulations.

- Is certified translation necessary in financial translation?

The necessity of a certified translation depends on the specific organization or institution to which you intend to submit your documents. It’s crucial to verify this requirement before proceeding with your translation request.

- What is a certified translation?

A certified translation is one that comes with a “Certificate of Translation Accuracy”, meaning that the translator or translation agency provides a signed statement testifying to the completeness and accuracy of the translation.

Sawatech: Your Financial Translation Partner

Sawatech is a leading translation and localization company based in Africa. We cover your translation and localization needs in more than 120 languages, particularly African languages, including rare ones.

Our financial specialists offer end-to-end financial services, including translation and localization, desktop publishing, and other multimedia services where we cater to all your needs.

The field of financial translation is extremely specialized and demands accuracy, knowledge, and a thorough comprehension of the target language as well as the financial sector. At Sawatech, we are aware of the significant difficulties involved in translating financial documentation.

Ensuring terminology accuracy is one of the main concerns because even the smallest mistake can result in serious misunderstandings or legal problems. Maintaining uniformity across massive document volumes—which is essential for compliance and clarity—presents another difficulty.

Financial translation is further complicated by managing the regulatory requirements and cultural quirks of several markets. Sawatech provides a plethora of free resources, such as white papers, case studies, ebooks, and infographics, to assist individuals and companies in this industry.

As an ISO-certified translation agency, we employ a strict quality assurance procedure to provide you with nothing but the best possible quality. We have great measures to protect your security, including a mandatory NDA and data security measures such as end-to-end encryption.

Whatever your financial needs are, we are here to help.